The Silicon Valley Bank Crash

Introduction to SVB

Silicon Valley Bank (SVB) was a major financial institution for the tech industry, serving startups, venture capital firms, and investors.

| Bank | Founded | Clients |

|---|---|---|

| SVB | 1983 | Tech Startups, VC Firms |

Causes of the Crash

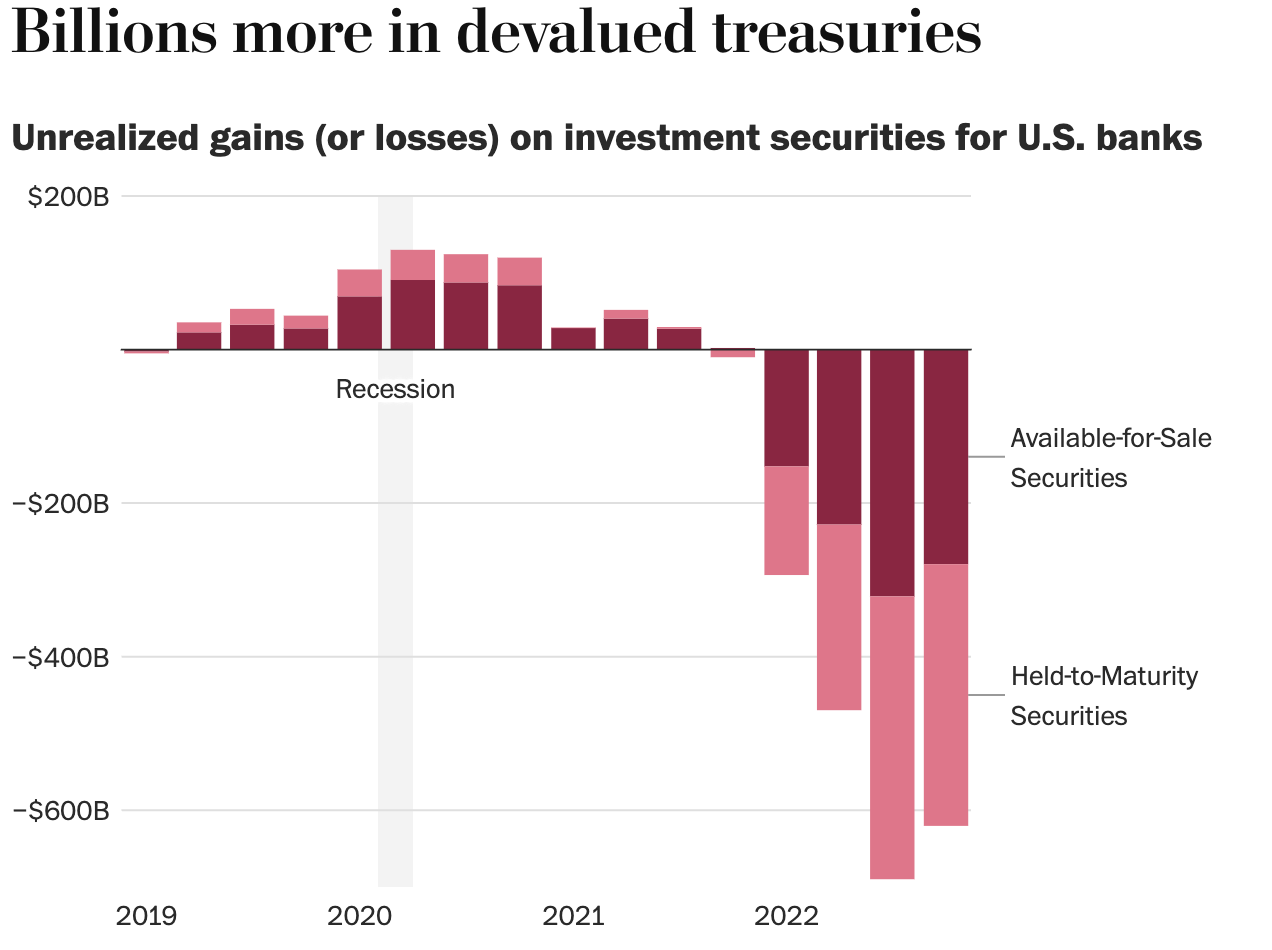

SVB heavily invested in long-term U.S. Treasury bonds. When interest rates rose sharply in 2022, the value of these bonds declined.

The collapse not only tarnished Silicon Valley's reputation as a hub of finance, but also had a widespread negative impact on global markets. Studies show substantial declines across major indices, including the top nine global equity indices, 53 global stock indices, and 43 financial sector indices.

Market Impact

SVB’s collapse triggered widespread uncertainty in the financial sector.

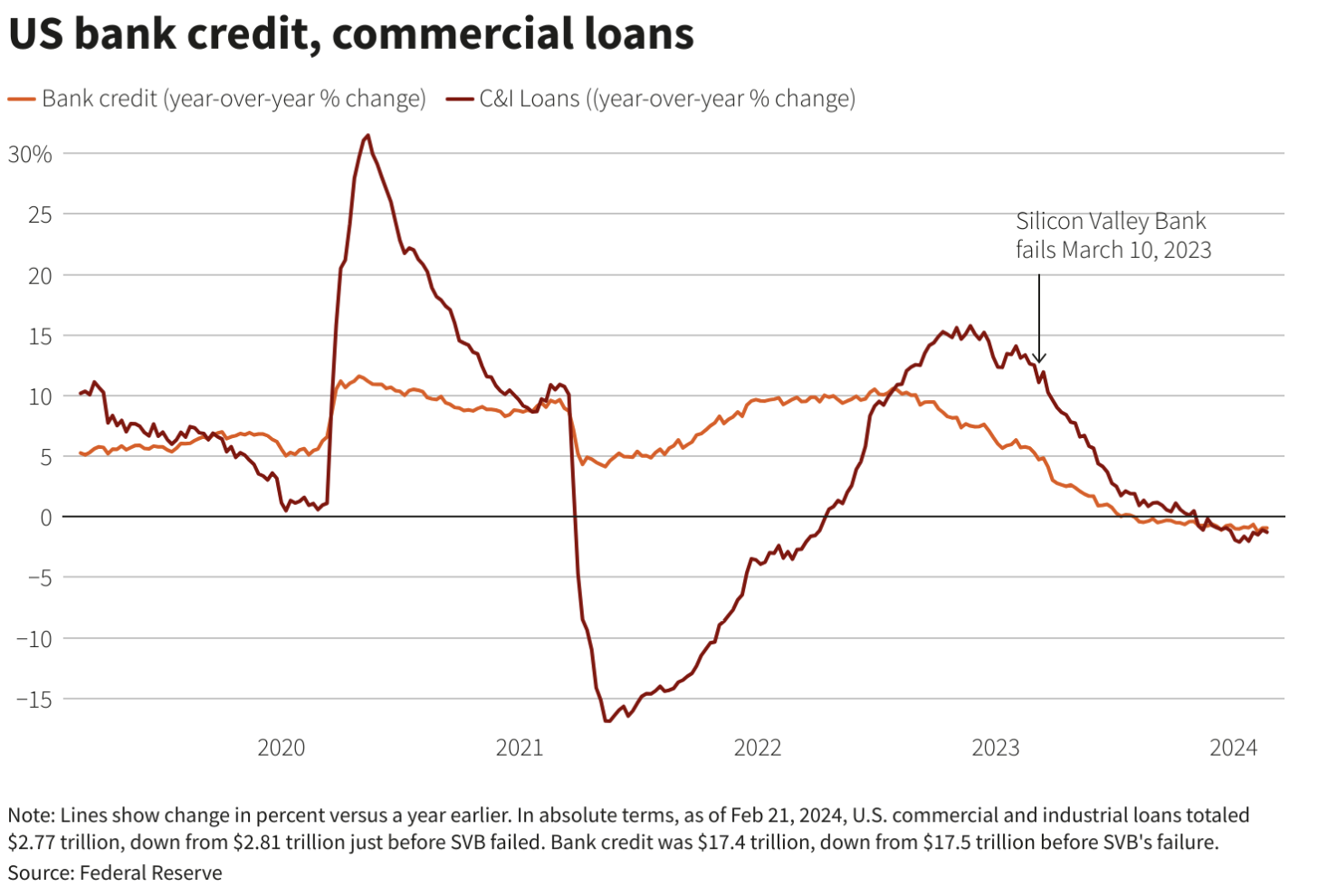

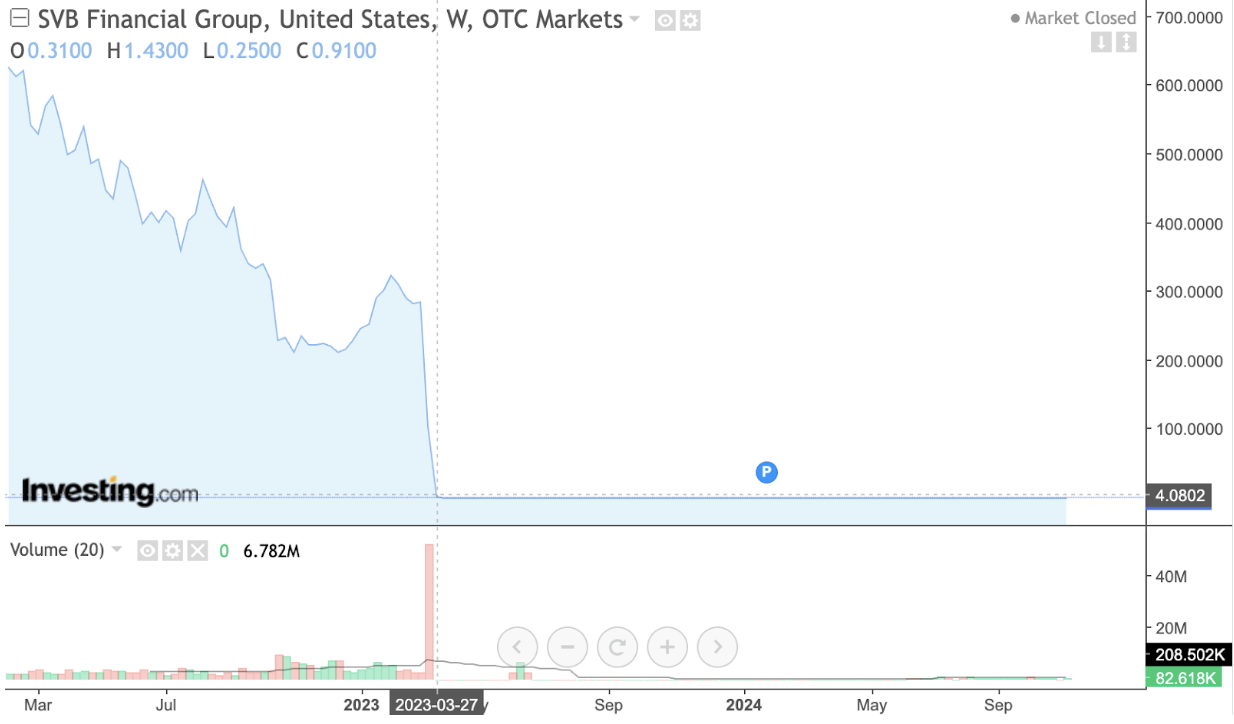

1. Political contagion caused many other regional banks to experience decrease in investors. Regional lenders such as the First Republic Bank saw its shares fall as much as 52% during early trading, and it continued to drop afterward. The graph below indicates a steep decline in SVB stock after March of 2023 indicating how much trust was lost in a singular month.

2. FDIC filed a lawsuit against 17 former executives and directors of SVB claiming gross negligence and breaches of fiduciary duty. They are trying to recover billions of dollars lost due to the collapse, which the FED is being accused of contributing to.

3. The collapse raised questions about changing interest rates and Federal Reserve policies. It also fueled debates about whether the public should continue entrusting their money to banks. Additionally, the steep drop in SVB deposits highlighted vulnerabilities in banking practices and the importance of diversifying financial strategies.

Legal and Political Implications

The FDIC took control of SVB and facilitated the sale of its assets. There were three main implications.

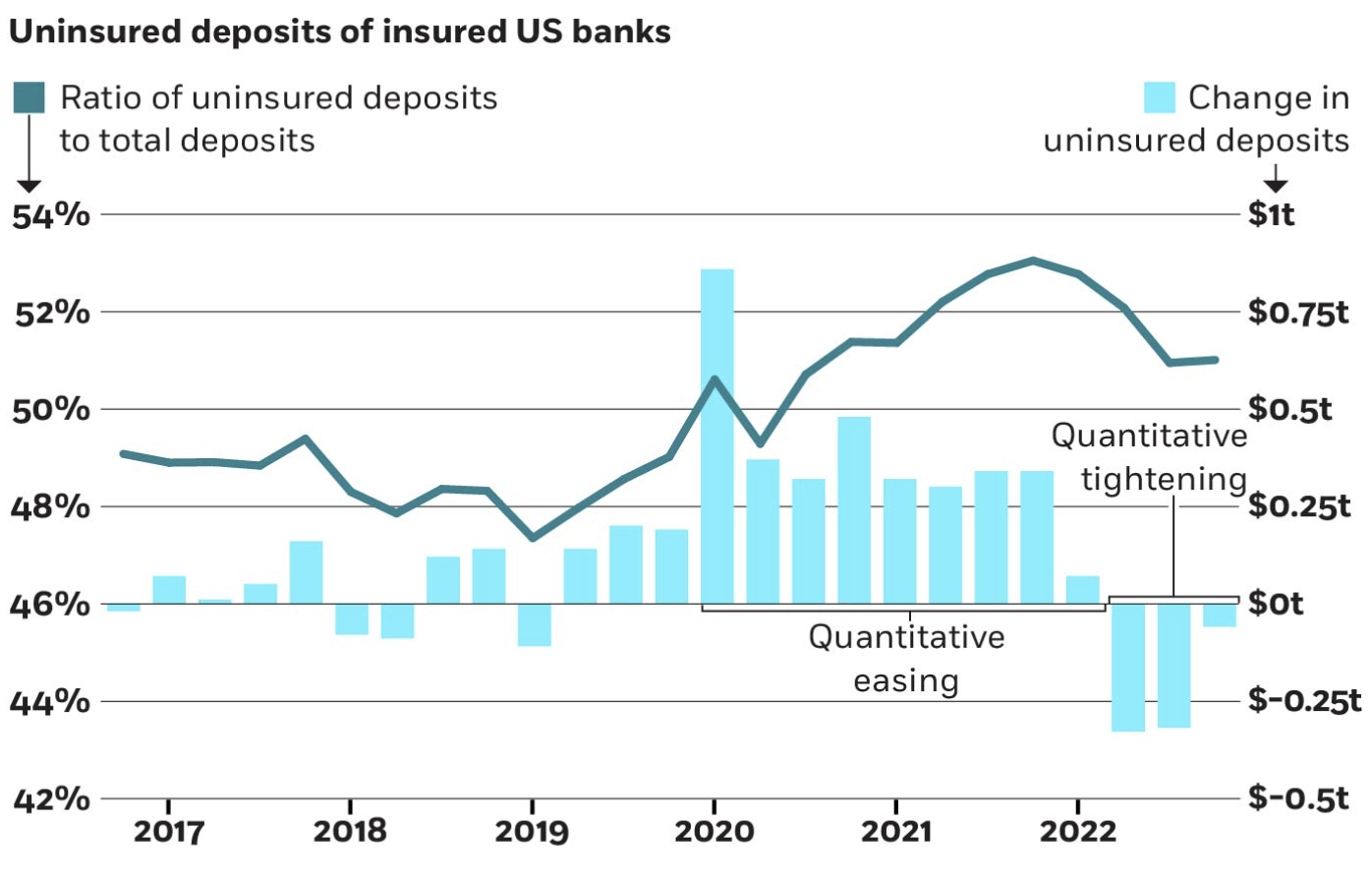

1. Since 94% of the deposits of Silicon Valley Bank and Signature Bank were uninsured, compared to the national average of around 50%, there is a deeper motivation for the public to be financially literate and ensure they are investing their money with full awareness of the risk.

2. The financial sector needs to reconsider the unrealized potential of depreciating bonds. U.S. banks are sitting on a staggering $620 billion in unrealized losses, according to the FDIC on the graph to the left. The problem only continues to deepen as short term solutions to this problem continue to arise.

3. Silicon Valley Bank (SVB) collapsed due to its heavy investment in fixed-rate securities during the pandemic, which made up 60% of its assets by the end of 2022.

Conclusion and Insights

The SVB collapse underscored the risks of undiversified investment strategies.

The public should understand that while the collapse of SVB and Silvergate Bank has raised concerns of financial instability and drawn comparisons to the Great Recession, these failures are primarily linked to their focus on high-risk sectors like cryptocurrency, startups, and venture capital, which are more sensitive to interest rate changes. Analysts emphasize that most banks today serve a broader range of customers, which helps protect them from similar risks. This gives hope that all moves for recovery are not lost, and historical data only depicts the numbers, and there is more to the situation than that.